child tax credit 2021 dates october

All eligible families could receive the full credit if. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days to.

Expanded Child Tax Credit Here Are The New Changes This Year

Around 36 million eligible American families will receive financial relief as part of the Child Tax Credit.

. The Child Tax Credit has been expanded from 2000 per child annually up to. Income limits associated with the expanded child credit are in effect for. The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably creating the largest US.

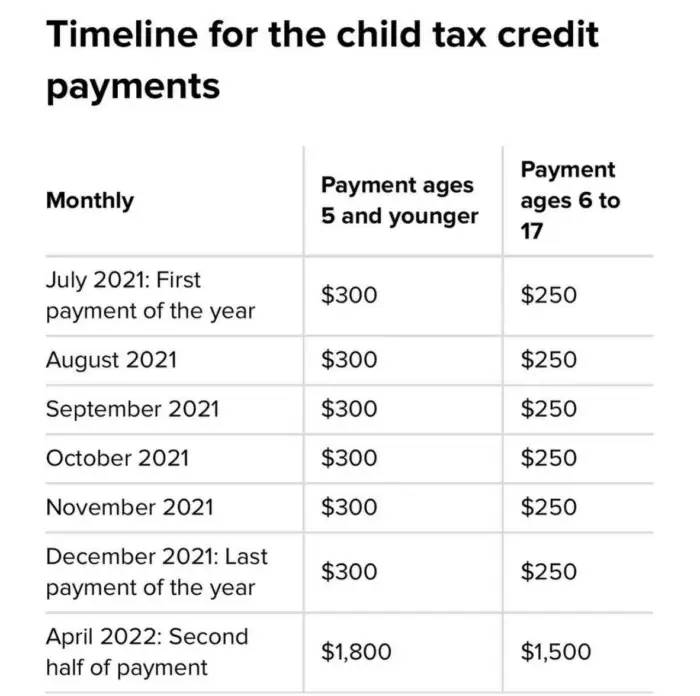

The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars depending on your personal situation. The IRS started sending out the fourth lot of Child Tax Credit payments on October 15 and millions will have already received this money either via direct deposit or by mail. It is worth remembering.

Wait 5 working days from the payment date to contact us. The credit enabled most working families to. 15 opt out by Aug.

The 2021 Child Tax Credit. October 20 2022. Goods and services tax.

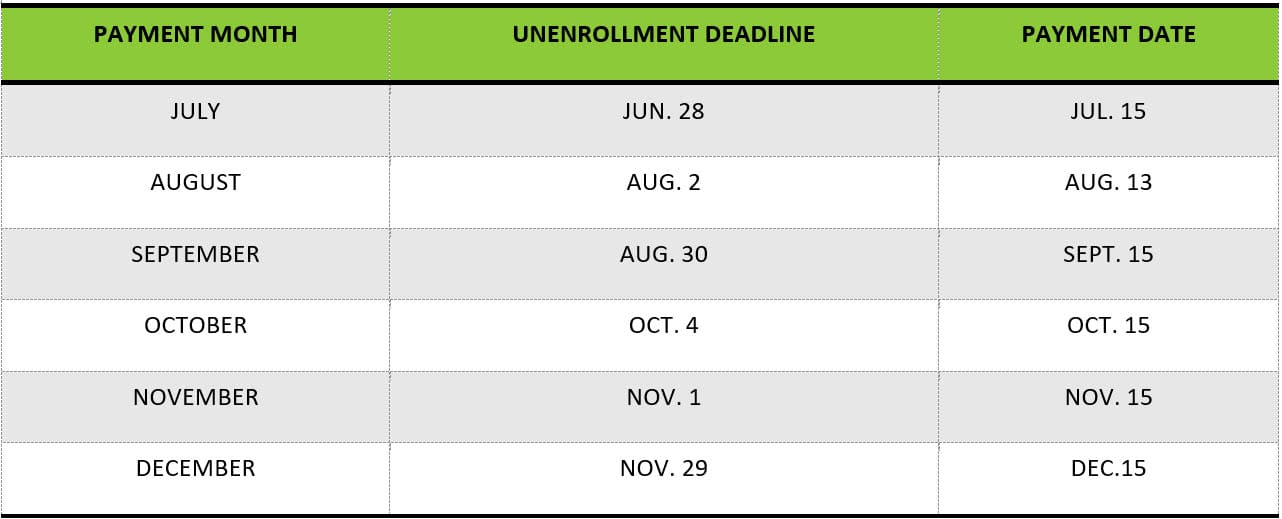

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Six payments of the Child Tax Credit were and are due this year. IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving.

Recipients can claim up to 1800 per child. Under the Biden administrations 2021 American Rescue Plan the child tax credit was expanded from 2000 per child to 3000 per child for children over the age of six and. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

That means another payment is coming in about a week on Oct. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Child tax credit ever.

The IRS has confirmed that theyll soon allow. What is the schedule for 2021. December 13 2022 Havent received your payment.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Child Tax Credit Dates Here S The Entire 2021 Schedule Money 2 days agoAccording to a recent audit from The Treasury Inspector General for Tax. These Are the Must-Know Dates for Child Tax Credits The remaining dates that families can expect the funds are September 15 October 15 November 15 and December 15.

Each payment is made on the 15th of the month. The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger.

The payment amount is calculated based on an individuals family situation in October 2022 and on their 2021 tax and benefit return. The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15. Of families will receive 3000 per child ages 6-17 years old and 3600 per.

The opt-out date is on October 4. Eligible families and individuals could. The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income.

13 opt out by Aug. That means another payment is coming in about a week on Oct. According to CNET the payment will come when families file taxes for 2021 at the start of next year.

Additional New York State Child And Earned Income Tax Payments

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Next Round Of Child Tax Credits Sent Out In Three Days See How Much You Ll Get The Us Sun

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

When To Expect Next Child Tax Credit Payment And More October Tax Tips

Advance Child Tax Credit Payments Begin July 15

Child Tax Credit Advanced Payments Information Bc T

What You Need To Know About The Expanded Child Tax Credit For 2021

Child Tax Credit Dates Last Day For December Payments Marca

Child Tax Credit Program Assistance Day Donaldsonville La

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

The 2021 Child Tax Credit John Hancock Investment Mgmt

Eligible Families Can Expect Child Tax Credit Payments For October

October S Monthly Cash Payment For Parents Will Be Sent Soon

Child Tax Credit File Your Taxes By October 17 To Claim Your 2021 Deduction Gobankingrates

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai